Understanding PrimeXBT Funding A Deep Dive Into Crypto Leverage Trading

Understanding PrimeXBT Funding: A Deep Dive Into Crypto Leverage Trading

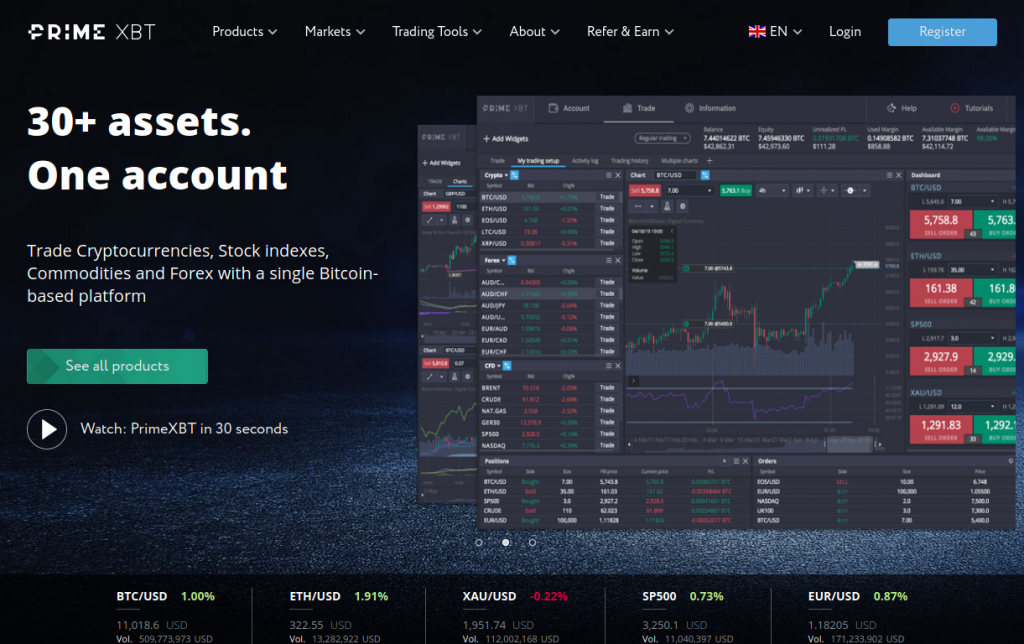

The world of cryptocurrency trading has opened up numerous avenues for traders to capitalize on the volatility and potential high returns of digital assets. One platform leading this charge is PrimeXBT Funding PrimeXBT pertukaran. This exchange offers a unique model that facilitates not just standard trades but also complex and leveraged strategies. Central to the efficiency of such trading mechanisms is the concept of funding. This article aims to explore the funding structure of PrimeXBT, providing insights into its workings and how traders can navigate this aspect to maximize their profitability.

What is PrimeXBT Funding?

Funding in PrimeXBT refers to the process of providing traders with the necessary capital to engage in leveraged trading. It operates under a model where traders can open positions that are significantly larger than their actual account balance. For example, with 100x leverage, a trader could open a position worth $10,000 by only using $100 in their account. This funding mechanism is integral to the platform’s appeal, as it allows traders to maximize their potential returns while exposing them to higher risks.

How Does PrimeXBT Funding Work?

The funding mechanism on PrimeXBT is designed to ensure that traders can maintain their leveraged positions without facing immediate liquidation. Here’s how it functions:

- Margin Requirement: When opening a leveraged position, traders must meet a margin requirement. This is a percentage of the total position size that they must have in their PrimeXBT account. For example, with 10x leverage, a 10% margin is required.

- Funding Fees: Unlike some trading platforms, PrimeXBT does not charge traditional trading fees for executions. Instead, there are funding fees that traders must pay to maintain their positions overnight, which is a crucial aspect to consider for long-term holds.

- Positive and Negative Funding Rates: Funding rates can either be positive or negative, depending on market conditions. If the demand for a particular position is high, the funding rate will be positive, and vice versa. This means that traders may either pay or receive funding fees based on the net position maintained.

Benefits of Using PrimeXBT for Funding

Beyond the mechanics of funding, PrimeXBT offers several benefits that can enhance a trader’s experience and potential for profit:

- High Leverage Options: PrimeXBT is known for offering some of the highest leverage options in the market, allowing traders to multiply their potential gains, which can be especially beneficial in a rapidly moving market.

- Diverse Asset Selection: The platform allows trading across a wide range of assets, including cryptocurrencies, commodities, indices, and forex. This diversification opens up multiple avenues for funding and investment strategies.

- User-Friendly Interface: PrimeXBT’s platform is designed intuitively, making it accessible for both novice and experienced traders to easily navigate the funding aspects, manage their positions, and perform trades without frustration.

Pitfalls to Consider with PrimeXBT Funding

While there are many advantages to using PrimeXBT for funding and trading, it is crucial to be aware of the potential pitfalls:

- High Risk: The allure of high leverage can lead to substantial losses as well as gains. Traders can quickly find themselves facing liquidation if they do not manage their margins carefully.

- Volatility: The crypto market is known for its volatility. Therefore, the funding costs may fluctuate considerably based on market conditions, leading to unexpected changes in traders’ P&L statements.

- Temporary Funding Spikes: During periods of high volatility, the funding rates can spike, leading to unexpectedly high fees for holding positions overnight.

- Margin Calls: Traders need to be cautious about the level of leverage they use; excessive leverage can lead to margin calls, which require the deposit of additional funds to maintain positions.

Strategies for Successful Funding Management

Effectively managing funding on PrimeXBT requires strategic planning and risk management. Here are several strategies traders can implement:

- Understand Leverage: Familiarize yourself with the concept of leverage and how it affects both potential profits and losses. Knowing when to reduce leverage can save you from unnecessary risks.

- Monitor Funding Rates: Keep a close eye on funding rates, as they can greatly affect the bottom line. Use this knowledge to enter or exit trades strategically, avoiding periods of high funding fees.

- Set Stop-Loss Orders: Implementing stop-loss orders can help protect your capital by automatically closing positions when losses reach a certain level, alleviating the risks tied to sudden market shifts.

- Trade Smaller Position Sizes: When investing with leverage, start with smaller position sizes to minimize risk exposure while you gain experience, gradually increasing as you become more confident.

Conclusion

PrimeXBT stands out as a formidable platform for traders looking to leverage their positions in the cryptocurrency market. Understanding the funding system is essential in maximizing the benefits while mitigating risks. With high leverage options, a diverse range of assets, and an intuitive interface, PrimeXBT empowers traders to tailor their strategies effectively. As you explore the potential of crypto trading, always bear in mind that informed trading, prudent risk management, and continued education on funding and leverage are vital to your success in this dynamic environment. Whether you are a newcomer or an experienced trader, understanding and navigating the nuances of PrimeXBT funding can enhance your trading experience and efficacy.